Bonds: Rolling with the Punches

November 16, 2022

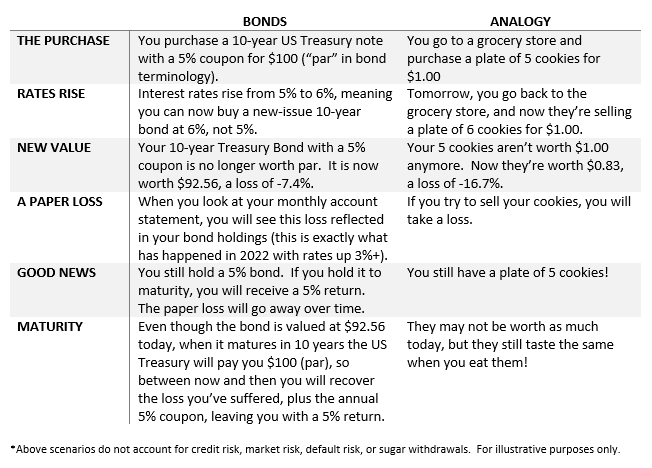

The normally quiet world of bonds has taken it on the chin in 2022. There is an inverse relationship between interest rates and bond prices – as rates rise, bond prices fall (and vice versa). High inflation and a Federal Reserve tasked with getting in front of inflation has caused interest rates to rise this year, creating a sell-off in the bond market. Making the sell-off even worse is that it came at the same time as a bear market for stocks – so there has been nowhere to hide during this cycle.

2022 is setting up to be the worst year for bonds back to 1976 when the Bloomberg Aggregate Bond Index (think of it as the S&P 500, but for bonds) was created. The “Agg” is currently down -14.3% year-to-date. Longer duration bonds, which are very sensitive to interest rate changes, are down even more, with the iShares 20+ Year Treasury Bond ETF (TLT) down -32.1% this year. Short-term bonds have been relatively defensive, with the Bloomberg 1-3 Year Credit Index down a manageable -4.2%.

The turmoil in fixed income land has created a lot of questions on bond performance, quality, and recovery potential. Here is how we think about bonds:

If you continue to hold the marked down bonds to maturity, the loss will go away, and you will earn your original purchase yield. This is what makes bonds defensive - you are guaranteed to earn your purchase yield (assuming no default risk). While prices may drop as rates rise (or move up as rates fall), there is a maturity date where we get our principal back, giving us a definitive end point.

In a rising rate environment, the sooner that maturity date comes, the better. That is why at Allied we’ve been positioned in short maturity bond funds. They are lower risk than long duration bonds (down less this year) and come with the benefit of faster repricing as rates rise.

Should interest rates show signs of peaking, or if credit spreads widen (allowing us to buy corporate bonds at higher yields), we will consider extending out maturities to more intermediate levels to lock in higher rates. While we’re not at the point yet, we are closely watching the market for opportunities.

Either way, in a rising rate environment or a falling rate market, we will keep our bonds in high-quality instruments with minimal credit and default risk. Our bond exposure is designed for portfolio income and diversification, not for taking risk.

If you have any questions about your account(s), or if there has been a change in your financial situation or investment objectives, please feel free to contact any member of our team at (406) 839-2037 to schedule a meeting.