Q1 2020: Retirement - The 4% Rule

February 12, 2020

How much money do I need to retire? That is one of the most common financial planning questions.

It confronts longevity risk - the risk of outliving your savings. While longevity is a great problem to have, it takes forward planning to meet the demands of an extended retirement, which begins with figuring out “how much.”

The short and probably unfulfilling answer is that everyone has a different solution. Variables like expected lifespan, retirement goals, social security, pension plans, and outside income all filter into the calculation. And this is before we have even discussed expected market returns, inflation, and tax structure.

A shortcut method, however, is the 4% rule. It’s a rule of thumb that will not give you a detailed, specific answer, but does point you in the right direction, which when it comes to financial planning, is often 80% of the battle.

Historic analysis has shown that an investor withdrawing no more than 4% from their investment portfolio won’t outlive their money. Studies going back to 1871 – nearly 150 years of data – have shown this to be consistent in every market cycle and condition. While there are no guarantees about what the future holds, a 60% stock / 40% bond portfolio has historically provided the diversification to meet the income needs of a 30 -year retirement.

The 4% rule is designed to be a conservative, fail-safe approach to retirement. The chart above shows every 30-year period since 1900, over 1,000 iterations, and not once has someone with drawing 4% from their portfolio run out of money. The worst case was the 30 years ending in June 1932, at the depths of the Great Depression, when the last monthly payment zeroed out the account, but that is the historic extreme.

In many cases, you could withdraw more than 4% per year, but this comes with its own risks. The average ending balance in the above chart is $2.7 million dollars, more than double the starting value of $1 million – even after 30 years of withdrawals. Based on longterm returns, a withdrawal rate as high as 6.6% would work, on average.

Yet “average” doesn’t account for a bad sequence of returns, which could leave you destitute. A bear market early in retirement, combined with annual withdrawals, can permanently impair your portfolio, making it difficult to recover. This is known as sequence risk, the danger that an early or extended portfolio drawdown can compromise your compounding ability.

Due to sequence risk, a 6% withdrawal rate fails nearly half the time. It’s like the analogy of the six-foot-tall man who drowned crossing the river that was five feet deep on average. In investing, surviving the average isn’t nearly as important as surviving the extremes, and the 4% level has never failed historically, surviving even the biggest drawdowns.

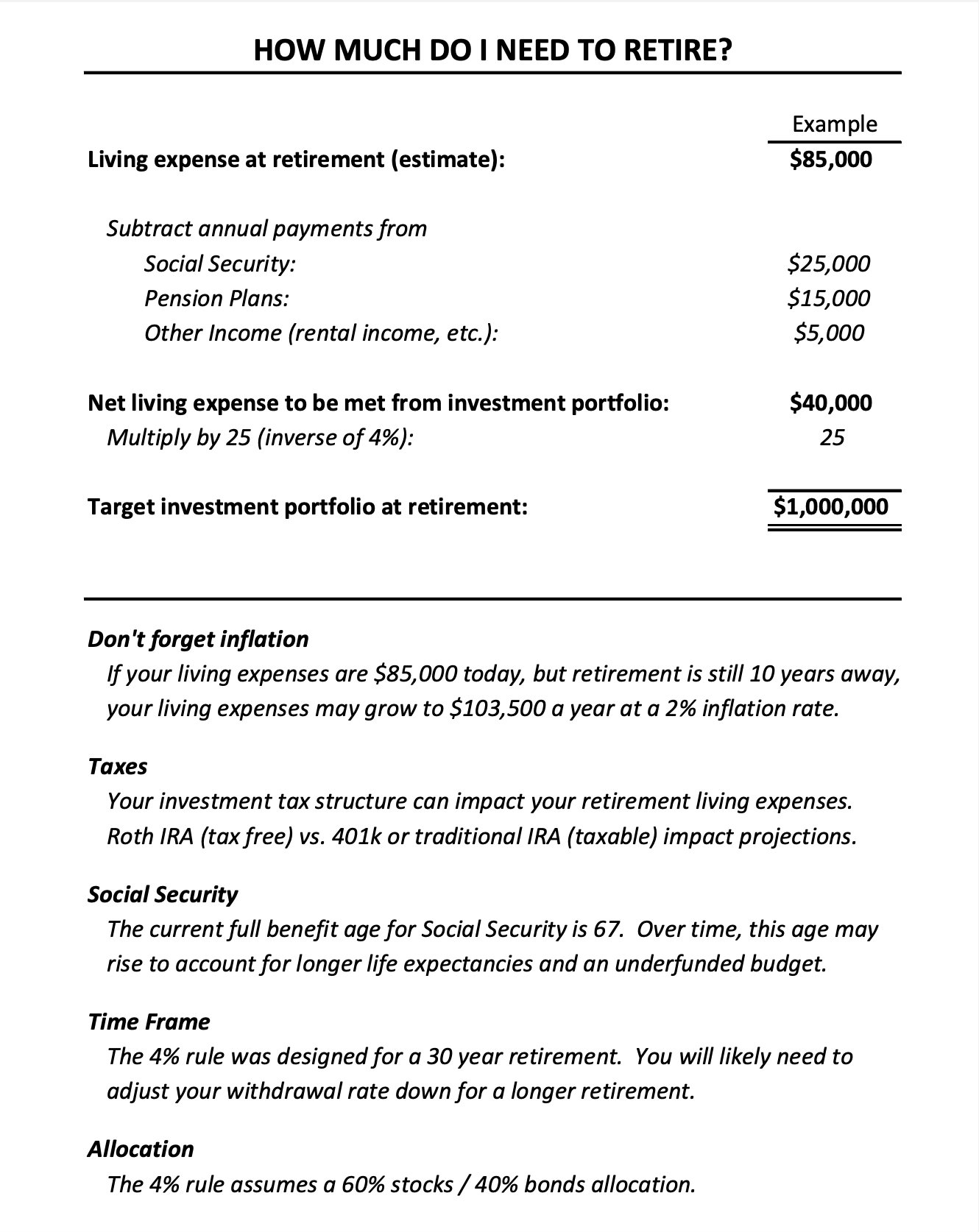

Reversing the 4% rule and starting with our desired withdrawal amount lets us back into how much money is needed for retirement. We figure out your desired annual retirement income level, netting out things like Social Security, pension income, or other outside income. We then multiply that net desired income level by 25 (the reciprocal of 4%), and we’re left with a target portfolio value.

If your desired retirement income is $85,000 per year, and you expect to get $45,000 a year from other sources (Social Security, pension, rent, etc.) then you’ll need a net $40,000 per year from your investment portfolio. Multiply $40,000 by 25, and you’re left with a target portfolio value of $1,000,000. This should be sufficient to meet the 4% rule and handle any sequence of returns (i.e. retiring into the teeth of a bear market) that the market throws at you – at least based on historic evidence.

Over the last ten years, the stock market has had an amazing run, compounding capital and growing retirement savings. Not every decade will look so good, making now an ideal time to review your retirement plan and goals. We would be happy to sit down with you and discuss the 4% rule or create a more detailed cash flow analysis to help in your financial planning process. We want to make sure you are on track for the retirement you have worked so hard for, with the right portfolio structure and risk tolerance. Let any one of our team members know and we’ll get the process started on a retirement roadmap.

If you have any questions about your account(s), or if there has been a change in your financial situation or investment objectives, please feel free to contact our team to schedule a meeting.