Q4 2020: End Of Year Strategy

January 18, 2021

You can say a lot of things about the past year, but it was certainly not dull. 2020 was a rollercoaster ride . . . and we’ve still got a month and a half to go!

COVID-19 dominated the news, the economy, and our lives. The election season was, to put it mildly, contentious, with a number of market implications. There were also manmade and natural disasters including wildfires, hurricanes, locust swarms, and killer bees, to name just a few.

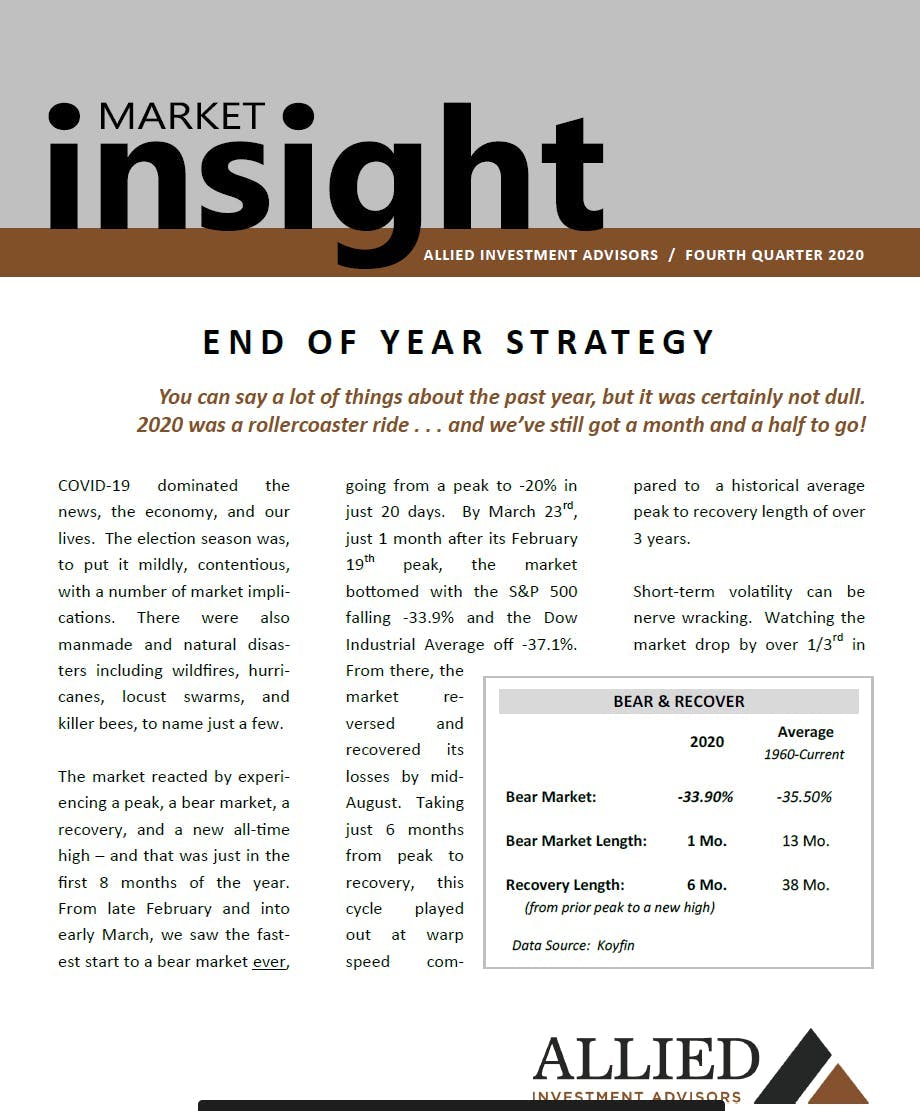

The market reacted by experiencing a peak, a bear market, a recovery, and a new all-time high – and that was just in the first 8 months of the year. From late February and into early March, we saw the fastest start to a bear market ever, going from a peak to -20% in just 20 days. By March 23rd, just 1 month after its February 19th peak, the market bottomed with the S&P 500 falling -33.9% and the Dow Industrial Average off -37.1%. From there, the market reversed and recovered its losses by mid-August. Taking just 6 months from peak to recovery, this cycle played out at warp speed compared to a historical average peak to recovery length of over 3 years.

Short-term volatility can be nerve-wracking. Watching the market drop by over 1/3rd in just 33 days can bring up tough questions. How long will the recovery take? Do I need to adjust my retirement plans? Are my spending plans in jeopardy?

To deal with short-term volatility, an allocation to bonds can help. Even in a low rate environment where bonds yield less than 1%, they still provide diversification and shelter in the storm. The below chart shows that while stocks dropped in March, bonds held relatively steady, keeping losses, and frayed nerves, to a minimum. While the S&P 500 fell -33.9%, the Bloomberg Aggregate Bond Index fell only -6% from peak to trough. A balanced portfolio of 50% stocks and 50% bonds also proved defensive, falling a manageable -17.6%.

THE BOND MARKET

Bonds have been in a bull market for nearly 40 years. The 10-year Treasury peaked at 15.8% in 1981, and rates have been steadily declining ever since, falling as low as 0.5% earlier this year. As rates fall, the value of already-issued bonds (with higher coupon rates) goes up, making the last four decades an unprecedented uptrend for bond prices.

This has made the annual return of a fixed income portfolio an amazing +7.1%. With rates compressing at or below 1%, we would not expect such high bond returns going forward. While not impossible (people have wrongly been calling the end of this bond bull market for years), it will become difficult to generate those type of returns outside of rates going negative.

Even in a low rate environment with low fixed income return expectations, bonds provide a good diversification tool. A strengthening economy may improve bond yields back into the more acceptable 2-3% range. Bonds also help offset short-term volatility as we saw earlier this year when returns were basically flat during the COVID-19 sell-off, while the equity market dropped -34%. While investing in bonds at around 1% returns isn’t glamorous, it does provide a good defensive tool in many portfolios.

While bonds provide a good defensive tool, investors who can look past the market’s short-term volatility have historically been rewarded. Over time, the market’s short-term volatility (both up and down) smooths out. Even the intense volatility of early 2020 doesn’t stand out on the above chart. Historically, over any 10- year period all the way back to 1928, the stock market is positive 95% of the time. For investors with a longer time horizon, equities provide a compelling option.

As we head into year-end and prepare for 2021, a few strategies:

• Timing the market is (exceedingly) difficult. Not many saw COVID-19 coming, and if anyone did, they had to then call an immediate turnaround and reinvest. As in many past market corrections, those who rode through the drawdown often do better than those trying to call the top and bottom.

• To help survive those inevitable drawdowns, we can help you dial-in the right stock and bond allocation for your risk tolerance. This is an exercise best done now, when the market is healthy rather than being faced with an impossible decision at the depths of a bear market.

• There are some positives on the horizon. News on the vaccine front is optimistic. A vaccine (or even the prospect of a vaccine) should bring confidence back to the economy, which would be a good thing for the market.

• We are also excited about our portfolio. While there are areas of overvaluation and excess in the market, there are also some great long-term value opportunities. This is where we have our portfolio focused.

• Volatility likely isn’t going anywhere, so even though bonds at sub 1% aren’t exciting, they can provide a good portfolio diversification (See “The Bond Market” callout above).

• Now is a good time to review tax-loss selling in your accounts. Depending on your tax strategy, capturing losses can help offset some or all of your realized capital gains. We would be happy to discuss this with you and your accountant.

If you have any questions about your account(s), or if there has been a change in your financial situation or investment objectives, please feel free to contact any member of our team to schedule a meeting.